What does probate really mean, and why do you want to avoid it?

Key Takeaways

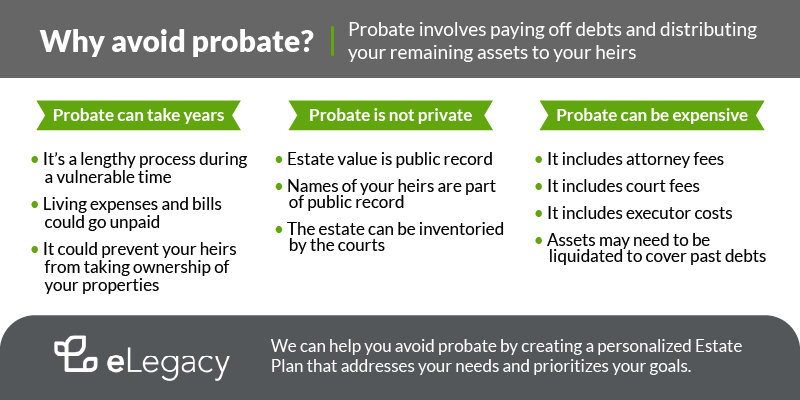

- Probate is the legal process of distributing your assets after death

- Probate can take years

- Probate is not private

- Probate can be expensive

- Assets in a Trust don’t go through probate

- Trusts offer other advantages over Wills, too

- A lawyer can help you set up a Trust

Losing a parent, a spouse, or any close loved one can be emotionally devastating, and adding time-consuming legal processes to the mix exacerbates the pain. Many people don’t want to think about the end of their lives. Unfortunately, if you are not proactive, you leave your loved ones with a lot of stress and paperwork.

An Estate Plan ensures that your assets go where you want them to go after your death, and it can also help your loved ones avoid the stress of probate. This post defines probate, helps you understand the process, and explains how setting up a Trust can help your estate sidestep the probate process.

What is probate?

Probate is the legal process of dealing with someone’s estate after their death. Everything you own becomes part of your estate when you die. The probate process involves paying off your debts and distributing the remaining assets to your heirs.

This process may sound simple, but on average, it takes nine to 24 months for an estate to go through probate. Some cases linger on for years, and your heirs have no right to your assets during this time.

What happens during probate?

Probate starts when a representative of your estate petitions the court to start probate. Typically, this person is an executor who was named to the position in your Will. If you did not have a Will, this person will be called an administrator. The person who takes on the administrator role varies based on the laws in your state, but generally, they are your spouse, child, parent, or other next of kin.

Probate starts by verifying your Will and evaluating the assets in your estate. The executor or administrator takes legal control of the assets and informs all of your known creditors that probate has started on your estate. Creditors must file their claims against the estate within a certain time frame, and if they fail to notify the courts, they may not be able to collect on the debts.

The executor pays all of the debts possible with liquid assets from the estate and sells assets as needed to pay additional debts. Then, they distribute the remaining assets based on the wishes outlined in your Will. The courts use state intestacy laws to determine who receives your assets if you do not have a Will.

What assets go through probate?

Every state has slightly different laws about which assets go through probate. Typically, jointly held assets, vehicles under a certain value, and retirement and life insurance accounts with named beneficiaries do not go through probate. Jointly held assets go directly to the joint owner, and retirement and life insurance accounts go to their named beneficiaries.

Everything besides these assets must go through probate. However, there is one exception — assets held in a Trust do not go through probate.

What are the disadvantages of probate?

Probate sounds pretty straightforward on paper, but this is a time-consuming process at a moment when people are feeling their most vulnerable and exhausted. A lengthy probate can prevent your heirs from taking over ownership of your properties, and if they rely on you to help with living expenses, your heirs may not be able to pay their bills, cover college tuition, or take care of other essentials.

Additionally, probate is not free. Your estate will face attorney fees, and may have to liquidate assets to cover old debts, executor costs, and court fees

Probate is also a public process. The courts may seal the inventory of your estate in some cases, but the fact that your estate is probated, the names of your heirs, and the value of your estate all become part of the public record.

All kinds of opportunists look at probate records, and your loved ones could be bombarded by calls urging them to sell your property for less than its value, purchase insurance plans, or liquidate your entire estate quickly.

An Estate Plan that sidesteps probate helps your loved ones avoid these predators, and it helps your family maintain their privacy.

How can you avoid probate?

A Trust allows your estate to avoid probate and ensures that your assets pass as quickly and as painlessly as possible to your heirs. A Trust is similar to a Will, but it offers a lot of distinct benefits that you cannot get with a Will.

You continue to own your assets when you transfer them into a Trust. You are both the grantor (creator) and the trustee (administrator) of the Trust when you are alive, and you name a successor trustee to take over after your death. The successor trustee ensures that your assets get distributed based on your wishes after your death, and this process can happen very quickly because the Trust does not need to go through Probate.

What is the difference between a Will and a Trust?

A Will is a document that allows you to outline where your assets go after your death. However, it does not prevent your assets from going through probate. A Trust also outlines where you want your assets to go after your death, and at the same time, it safeguards your property and helps avoid probate.

Trusts also let you set up very specific guidelines on how you want your assets distributed. Say you only want your children to receive money from your estate after they reach a certain age — A Trust allows you to make this election, but a Will does not.

Avoid probate and create an Estate Plan today

Remember: Probate can drag on for years, and your loved ones don’t need the additional stress while they’re grieving. Creating an Estate Plan can feel intimidating, but at eLegacy, we strive to make the process as easy, safe, and convenient as possible for our clients. All it takes is five easy steps:

- Complimentary consultation: Meet with one of our Estate Planning specialists to discuss your background, goals, family, and concerns. You will receive a quote for your customized Estate Plan.

- Design meeting: We schedule a meeting to work through the details of your custom plan, ensuring it addresses your needs and wishes.

- Drafting and review: We begin drafting all the necessary documents, including the Will, Trust, Power of Attorney, or other necessary documents. You will then review the documents and provide feedback or ask any questions.

- Signing and delivery: Once revisions are complete and the documents are approved, you will sign the documents either in-person or via videoconference so we can notarize them virtually.

- Funding (for Trust-based plans): If you have a Trust-based plan, it must be “funded” or else it may not work as intended.

Don’t let your assets get tangled up in probate — contact us today to talk more about the benefits of a Trust for you and your family.